Capital Allocation Frameworks at a Glance

Liquidity Transmission Framework

Liquidity Transmission Framework

At FatCat Capital, the objective is not to forecast prices but to understand structure.

Markets are shaped by the interaction between policy, liquidity, positioning, and narrative.

These forces are rarely linear and often reflexive. The frameworks discussed are designed to make those interactions observable and to impose discipline on interpretation.

Each framework is:

- Grounded in observable data

- Explicit about assumptions

- Clear on what would invalidate the view

They are tools for thinking, not signals for action.

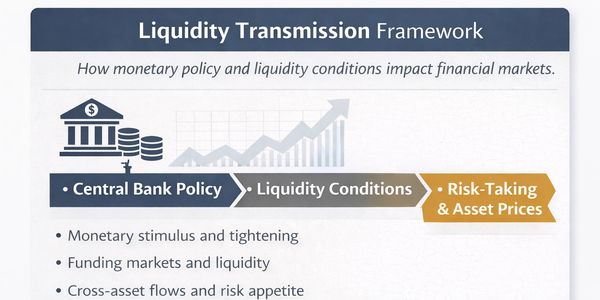

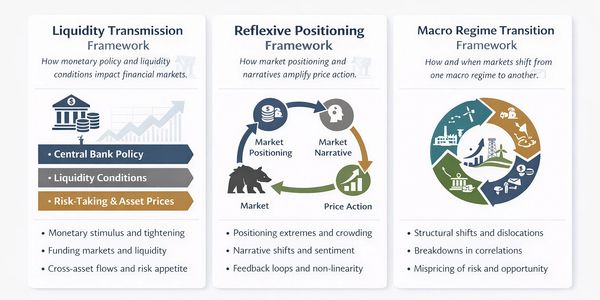

Liquidity Transmission Framework

Liquidity Transmission Framework

Liquidity Transmission Framework

What it addresses

How monetary policy and liquidity conditions propagate through financial markets.

Core question

Is liquidity expanding or contracting at the margin, and how is that transmission affecting risk-taking?

Primary use

To define the macro environment and background conditions in which other risks are taken.

Reflexive Positioning Framework

Macro Regime Transition Framework

Macro Regime Transition Framework

What it addresses

How market positioning, narratives, and price action reinforce one another.

Core question

Where is positioning creating asymmetry, fragility, or amplification beyond fundamentals?

Primary use

To assess vulnerability, crowding, and the potential for nonlinear moves.

Macro Regime Transition Framework

Macro Regime Transition Framework

Macro Regime Transition Framework

What it addresses

How and when markets shift from one macro regime to another.

Core question

Are established relationships breaking down, and is the market still pricing the old regime?

Primary use

To identify periods where risk is most likely to be mispriced during structural change.

How the three frameworks fit together

Frameworks are not used in isolation. They are layered.

The liquidity transmission framework defines the environment. The reflexive positioning framework outlines fragility and amplification. Meanwhile, macro regime transition and narratives determine timing and asymmetry. When all three elements align in the same direction, markets typically move decisively. Conversely, when they conflict, exercising patience becomes more important than holding conviction.

Together, they help answer three questions:

What macro regime transition are we currently experiencing? Where is risk being mis-priced within the liquidity transmission framework? What factors would trigger a reassessment in the reflexive positioning framework?

© 2025 FatCat Capital Ltd. All rights reserved.

Registered in Ireland

Company Registration No: 806050

Registered Office: Swords, Co. Dublin

Thank you